Daimler Truck Capital Market Day 2025 | “Stronger 2030” - Evolution of Group Strategy and upgraded Financial Targets 2030

Download

Daimler Truck Capital Market Day 2025 | “Stronger 2030” - Evolution of Group Strategy and upgraded Financial Targets 2030

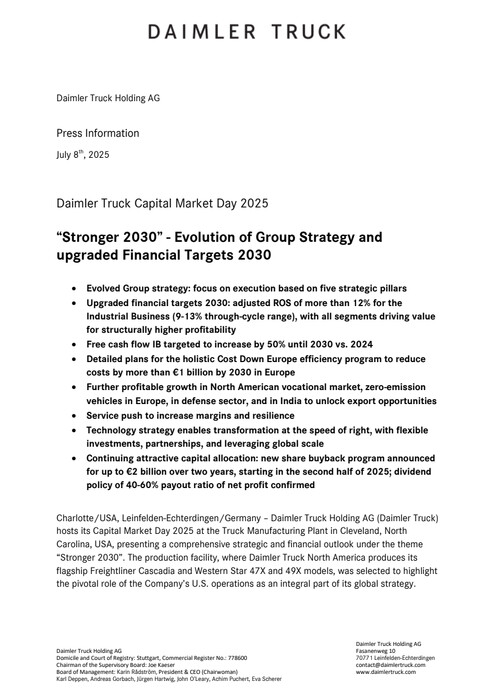

Evolved Group strategy: focus on execution based on five strategic pillars Upgraded financial targets 2030: adjusted ROS of more than 12% for the Industrial Business (9-13% through-cycle range), with all segments driving value for structurally higher profitability Free cash flow IB targeted to increase by 50% until 2030 vs. 2024 Detailed plans for the holistic Cost Down Europe efficiency program to reduce costs by more…

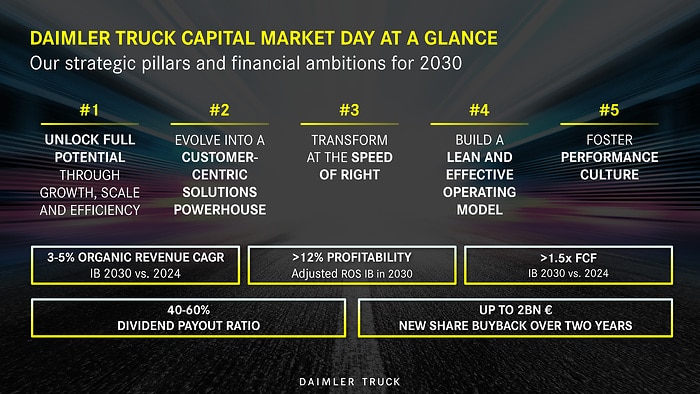

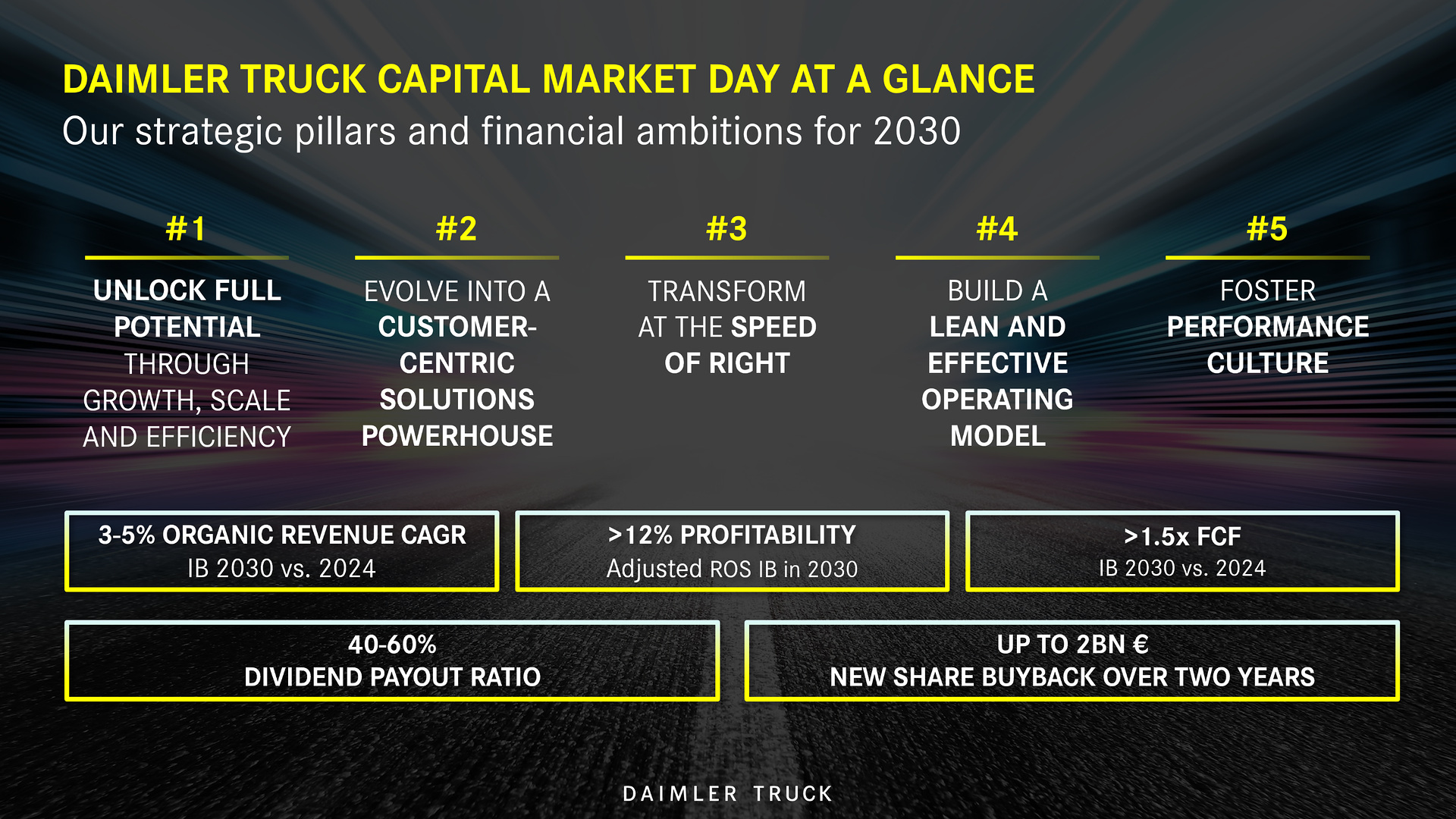

- Evolved Group strategy: focus on execution based on five strategic pillars

- Upgraded financial targets 2030: adjusted ROS of more than 12% for the Industrial Business (9-13% through-cycle range), with all segments driving value for structurally higher profitability

- Free cash flow IB targeted to increase by 50% until 2030 vs. 2024

- Detailed plans for the holistic Cost Down Europe efficiency program to reduce costs by more than €1 billion by 2030 in Europe

- Further profitable growth in North American vocational market, zero-emission vehicles in Europe, in defense sector, and in India to unlock export opportunities

- Service push to increase margins and resilience

- Technology strategy enables transformation at the speed of right, with flexible investments, partnerships, and leveraging global scale

- Continuing attractive capital allocation: new share buyback program announced for up to €2 billion over two years, starting in the second half of 2025; dividend policy of 40-60% payout ratio of net profit confirmed

Charlotte/USA, Leinfelden-Echterdingen/Germany – Daimler Truck Holding AG (Daimler Truck) hosts its Capital Market Day 2025 at the Truck Manufacturing Plant in Cleveland, North Carolina, USA, presenting a comprehensive strategic and financial outlook under the theme “Stronger 2030”. The production facility, where Daimler Truck North America produces its flagship Freightliner Cascadia and Western Star 47X and 49X models, was selected to highlight the pivotal role of the Company’s U.S. operations as an integral part of its global strategy.

At the Capital Market Day, Daimler Truck presents its evolved Group strategy which is anchored in five strategic pillars to drive higher profitability and increased resilience. Following this strategy, Daimler Truck sets ambitious financial targets for 2030. The Company aims to achieve an adjusted return on sales (adj. ROS) of more than 12% in its Industrial Business (IB). Furthermore, the Group will continue its shareholder-oriented capital allocation strategy and has announced a new up to €2 billion share buyback program over two years, expected to start in the second half of 2025.

Karin Rådström, President & CEO of Daimler Truck: “At Daimler Truck, we are proud to work for all who keep the world moving. And we want to build the best truck and bus company - for our customers, our employees and our shareholders. We have the strategy in place, and we are establishing the performance culture to achieve this ambition. When we do it right, it brings us to a profitability of more than 12% return on sales by 2030.”

Evolved Group Strategy - Five Strategic Pillars

Unlock full potential through growth, scale, and efficiency: the Group focuses on scale where it matters most. This is underscored by the signing of the agreement to integrate Mitsubishi Fuso and Hino.

Evolve into a customer-centric solutions powerhouse: in 2024, Daimler Truck generated over €8 billion in service revenue in its Industrial Business. The Company will further push its service business by improving parts availability and additional investments in the retail and service network, therewith enhancing customer proximity.

Transform at the speed of right: Daimler Truck is carefully balancing future investments in both diesel and zero-emission technologies. A modular technology strategy has been adopted, supported by partnerships such as Coretura, a joint venture with Volvo Group, focused on software-defined vehicle platforms.

Build a lean and effective operating model: the Group has recently launched the “Cost Down Europe” program, which is expected to deliver more than €1 billion in cost savings by 2030 in Europe. This initiative includes structural cost reductions, headcount optimization, increased labor flexibility, and standardized operational practices across German sites.

Foster a high-performance culture: Daimler Truck is undergoing an internal cultural transformation which is – like the four other pillars - also guided by the principles of “Simpler. Faster. Stronger.”. This includes streamlining organizational structures, accelerating decision-making, fostering accountability, and implementing a reinforced pay-for-performance model.

Upgraded Financial Targets 2030 and New Share Buyback Program

Focusing on these new strategic priorities shall enable Daimler Truck to increase its profitability, grow more resilient and increase free cash flow of the Industrial Business by 50% by 2030, allowing the Group to continue its track record of attractive shareholder returns.

Daimler Truck has set clear financial targets for its Industrial Business through 2030. The Company aims to achieve an adj. ROS of more than 12%, with a through-cycle range of 9% to 13% in its core Industrial Business. Organic revenue growth is projected at 3 to 5 percent per annum through 2030, driven by a strong service push, transformation to zero-emission vehicles in Europe, vocational trucks in North America, growth in India, and in the defense sector. Return on capital employed (ROCE) is targeted at 40 to 50 percent by the end of the decade.

Daimler Truck has announced a new share buyback program with a value of up to €2 billion over two years, expected to start during the second half of 2025. The Group remains fully committed to returning excess cash to shareholders through its share buyback program. Furthermore, the Group confirms its attractive dividend payout policy in the range of 40 to 60 percent of net profit.

“By consistently executing our new strategic priorities, we will deliver a step-change in financial performance, driven by our comprehensive Cost Down Europe efficiency program. The combination of resilient growth, disciplined capital allocation, and improved profitability will significantly elevate our strong cash generation. We will continue to reward our shareholders by reaffirming our dividend policy of 40 to 60 percent payout ratio, and by implementing our new share buyback program of up to two billion euros”, says Eva Scherer, CFO of Daimler Truck.

Mercedes-Benz Trucks: Restructure, Leverage and Grow

At Mercedes-Benz Trucks, the focus is clearly set on turning potential into profit. After delivering strong results in 2023, recent profitability has shown that the segment needs to become more resilient, fully utilizing brand strengths, pricing power, and scale. With the Cost Down Europe efficiency program, the Company aims to set Daimler Truck in Europe up for success and to deliver more than €1 billion cost savings in Europe by 2030.

The comprehensive and detailed restructuring plan covers six core cost reduction areas. The plan includes a shift of production volume to a best-cost country and further measures, leading to a significant job reduction in Germany by 2030. Following the agreement recently made with the Works Council, the Company will utilize natural attrition and expanded early retirement options to reduce positions in a socially responsible manner as well as offer targeted severance packages.

Mercedes-Benz Trucks ONE (“MBT ONE”), a newly launched modular strategy approach, will leverage the global scale and team across the segment, ensuring harmonization and strengthening of the product portfolio along customer needs while reducing product complexity.

The segment strategy of Mercedes-Benz Trucks includes four growth initiatives: Doubling of the high-margin defense business, growing units of zero-emission vehicles to over 25,000 unit sales in Europe by 2030, growth in India in both the domestic and export markets and strongly pushing the high-margin service business.

“At Mercedes-Benz Trucks, our focus is first and foremost on our customers. We want to deliver the products and services that make their business more successful – today and in the future. Therefore, we are focusing on three strategic levers: restructure, leverage and grow. We will restructure our organization for higher efficiency and reduced complexity – primarily by delivering on our Cost Down Europe program. We will fully leverage our new ‘ONE global team’ with India and China being part of Mercedes-Benz Trucks – this includes leveraging our global talent pool and best-cost countries, while also boosting our global scale. And, we will grow in areas with major potential, such as zero-emission trucking in Europe, the defense sector, as well as our parts and services business. We brought our business in Latin America back to profitable growth. So we can do it – and we are fully committed to doing it at Mercedes-Benz Trucks globally”, says Achim Puchert, Member of the Board of Management of Daimler Truck, responsible for Mercedes-Benz Trucks and BharatBenz.

Daimler Truck North America: Scale, Sustain and Streamline

Daimler Truck North America (DTNA) has continued to deliver strong financial results, reinforcing its role as a core profit driver within the Daimler Truck Group. Since the last Capital Market Day, DTNA has exceeded its 2025 financial targets ahead of schedule, achieving a 12.9% adjusted return on sales in 2024. This performance has been driven by a disciplined focus on value-based pricing, self-help cost reductions, an optimized product mix, and close collaboration with dealers and customers to align offerings with total cost of ownership advantages. Having established a strong 24% market share in the heavy vocational market in 2024, the ongoing success of the vocational product strategy will build scale and profitability.

Despite ongoing market volatility and supply chain disruptions, DTNA has demonstrated exceptional resilience and operational agility. These results underscore DTNA’s ability to deliver sustainable, profitable growth and long-term value creation for the Group.

DTNA is pursuing a highly scalable, customer-centered strategy to drive long-term value – empowering customers operate more effectively, while positioning DTNA for leadership and resilience in the rapidly evolving services space. At the same time, DTNA is further growing its vocational and service offerings.

“Daimler Truck North America has delivered consistently strong financial performance over the past years, and we’re building on that momentum”, says John O’Leary, Member of the Board of Management of Daimler Truck and CEO & President of DTNA. “We’ve strengthened our leadership position in North America with the launch of the Fifth Generation Freightliner Cascadia, and continued success of the Western Star vocational lineup. The combination of the vocational market’s lower cyclicality and the growth of our service business will further enhance our resilience, long-term growth and overall profitability.”

Truck Technology: Mastering the speed of right

To navigate uncertainty and balance the Company’s technological advancements for both diesel and zero-emission vehicles, Daimler Truck emphasizes the importance of three crucial strategic levers: flexible investments, partnerships, and leveraging global scale.

Acknowledging evolving and unpredictable dynamics in external factors such as energy prices, subsidies and regulatory requirements as well as a divergence in the speed of decarbonization across Daimler Truck’s core markets, the Group is adapting its powertrain strategy. This applies particularly to the North American market, as the speed of zero-emission vehicle adoption has slowed down and led the Group to ramp down its zero-emission powertrain platform investments. Daimler Truck will ensure the long-term competitiveness of its heavy-duty engine, by leveraging global platforms and scale.

On the battery-electric side the Company will pragmatically balance make or buy-decisions and move to truly truckified zero-emission platforms in line with the market uptake. When it comes to hydrogen powertrain development, the Company is focused on Europe. However, progress in building out hydrogen refuelling stations has been much slower than expected. Daimler Truck therefore is moving the large-scale fuel cell industrialization and planned series production of hydrogen-powered trucks to the early thirties.

Moreover, Daimler Truck is making significant strides toward the future of trucking with Coretura, the recently announced joint venture with the Volvo Group, with the goal to create an industry standard software-defined vehicle platform. This platform aims to revolutionize truck operations by enabling all-new functionalities, continuous fleet improvements and optimized total cost of ownership through software-only features.

“Our flexible, modular technology strategy enables Daimler Truck to transform at the speed of right. Depending on the transformation speed in different markets, we deliver the right technologies at the right time, to make the business of our customers more successful and to create global scale for Daimler Truck. This accounts for both diesel and zero-emission propulsion systems as well as for software and electronics in the truck”, says Andreas Gorbach, Member of the Board of Management of Daimler Truck, responsible for Truck Technology. “With flexible investments, strong partnerships, and a focus on global scale, we are well-positioned to lead the future of trucking.”

Additional information and documents such as the Capital Market Day presentation are available online in Daimler Truck’s investor relations section:

Daimler Truck Capital Market Day 2025 | Daimler Truck

Additional content for the media is available in Daimler Truck’s newsroom:

Daimler Truck Newsroom | Capital Market Day 2025

Daimler Truck Holding AG is listed in Germany's stock market index DAX. Daimler Truck Holding AG shares are traded on the Regulated Market (Prime Standard) of the Frankfurt Stock Exchange under the stock symbol DTG. The International Securities Identification Number (ISIN) is DE000DTR0CK8, the German Securities Identification Number (WKN) DTR0CK.

Article assets

Daimler Truck Capital Market Day 2025 | “Stronger 2030” - Evolution of Group Strategy and upgraded Financial Targets 2030

Daimler Truck Capital Market Day 2025 | “Stronger 2030” - Evolution of Group Strategy and upgraded Financial Targets 2030

Daimler Truck Capital Market Day 2025 | “Stronger 2030” - Evolution of Group Strategy and upgraded Financial Targets 2030

Daimler Truck Capital Market Day 2025 | “Stronger 2030” - Evolution of Group Strategy and upgraded Financial Targets 2030

Daimler Truck Capital Market Day 2025 | “Stronger 2030” - Evolution of Group Strategy and upgraded Financial Targets 2030

Daimler Truck Capital Market Day 2025 | “Stronger 2030” - Evolution of Group Strategy and upgraded Financial Targets 2030

Daimler Truck Capital Market Day 2025 | “Stronger 2030” - Evolution of Group Strategy and upgraded Financial Targets 2030

Daimler Truck Capital Market Day 2025 | “Stronger 2030” - Evolution of Group Strategy and upgraded Financial Targets 2030

Jörg Howe

Former Special Representative Communications & External Affairs

-

Thomas Hövermann

Head of Corporate Communications Daimler Truck Group

thomas.hoevermann@daimlertruck.com

+49 176 30984119

Maximilian Splittgerber

Spokesperson Global Finance Communications

maximilian.splittgerber@daimlertruck.com

+49 160 860 71 24